Toolbox of the CMO – architect of customer experience

We see that traditional banks fall behind compared to FinTechs when looking at true omnichannel and personalised experiences. Are banks ready to transform customer journeys? Our latest World Retail Banking Report tells us that 95% of bank executives indicated that outdated legacy systems and core banking modules inhibit efforts to optimise data and customer-centric growth strategies. A siloed and disconnected data approach makes many banks ill-equipped to take the next step in engaging their customers.

The question is who is best positioned to drive this transformation? Is it the chief marketing officer, chief digital officer, or chief information officer that should be responsible for happy customers? We see that CMOs, as architects of customer experience, could accelerate the transformation by using data-driven precision marketing at scale to create individualised journeys for customers across channels. But many CMOs are not there yet. There are big steps to take first, as our latest World Retail Banking Report showed that:

- just 34% of CMOs have direct management of marketing analytics,

- only 37% have direct responsibility for marketing technologies,

- just 22% directly manage end-to-end customer experiences or have access to complete customer profiles needed to do the job right,

- and only 28% directly manage customer feedback, which is key to success in the new banking market.

Facing the data challenge – business and IT alignment

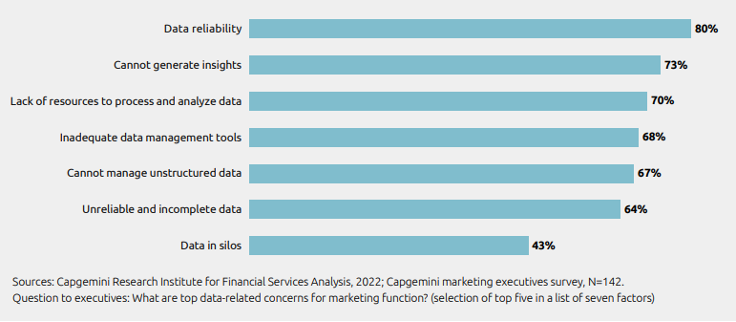

So, to be able to connect the dots for a fully optimised customer journey and simultaneously boost data integrity, security, and privacy, CMOs should work shoulder to shoulder with the chief technology officer, chief data officer, chief compliance officer, and other leaders to improve data governance and drive the push to unify data from different silos and sources into a centralised data repository, such as a customer data platform (CDP). Nowadays, banks possess vast and varied amounts of customer data that they are unable to leverage. Seventy-three percent struggle to turn it into useful insights, and eighty percent of the executives in our survey cited data reliability as a concern.

Spearheading channel coordination

From conventional channels like branches, mobile apps, and websites to newer channels such as social media, voice assistance, and wearables, or even completely new and emerging technologies like the metaverse and web 3.0, every customer journey needs to be built consistently and end-to-end across channels. CMOs can lead channel coordination by collecting, aggregating, and assimilating customer data to map customer journeys and anticipate customer needs to present experiences that look and feel the same across channels. With a uniform KPI framework across channels and teams, focus should be given to the full journey and not only to micro-journeys at channel level.

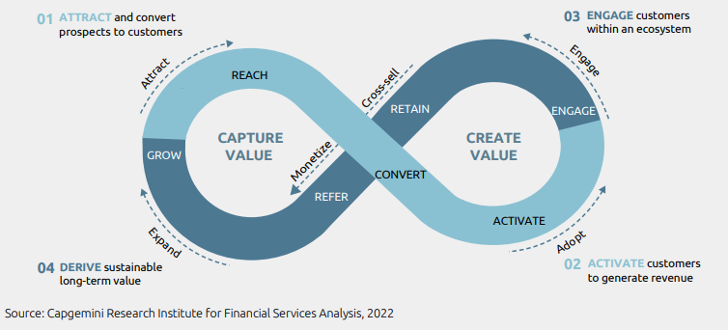

Employ a value loop approach

Coming back to the main question of this blog: what’s the magic bullet to transform customer engagement? Well, use data like a FinTech does and employ a value loop approach to attract, engage, and create long-term value for customers while improving their experience. It means you constantly need to improve the journey with agile process improvements strongly aligned with the full organisation (CDO, CIO, and so on) and:

- make AI and machine learning part of the customer journey,

- centralise data and set up strong data governance,

- and embrace just-in-time experiences to be spot on.

If you would like to learn more about the voice of the customer and bank executive research we have done, you can download our full World Retail Banking Report. We are happy to discuss and share further insights.